Cashback vs Travel Rewards: Which Credit Card Strategy Actually Pays Off?

I used to think all credit cards were basically the same — swipe, pay, repeat. But once I started paying attention to rewards, I realized something big:

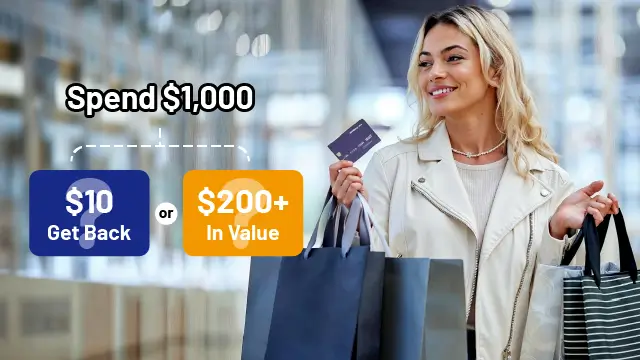

The same $1,000 you spend can either give you $10 back… or $200+ in value.

It all depends on whether you’re earning cashback or travel points — and how you redeem them.

So let’s break down the difference in the most honest, real-life way possible — as someone who has learned this by actually booking flights and paying for groceries using rewards, not just reading marketing pages.

🤑 Cashback: Simple, Flexible, Instant Savings

Cashback is exact money earned back on your spending. No math, no games. If a card gives:

- 1.5% cashback → You get $15 back on $1,000 spent.

- 6% cashback at supermarkets → $60 back on $1,000 groceries.

When Cashback Makes the Most Sense

Choose cashback if you:

✔ Don’t want to think about “travel point value”

✔ Spend mostly on groceries, Amazon, gas, dining

✔ Want savings you can use immediately

My Real Example:

Last December, I spent roughly:

- $780 on groceries

- $220 on gift wrap, holiday food items

- $1,100 on Amazon gift shopping

Using a cashback card:

→ I earned $186.40 back, which I used to pay down the next statement. Simple. No work. That’s the appeal.

✈️ Travel Rewards: More Work, Higher Value (When Done Right)

For example:

- 30,000 points could be worth $300,

- or $600–$1,200 if transferred to airline/hotel partners.

That’s why travel rewards can feel amazing when you get it right.

When Travel Rewards Make Sense

Choose travel rewards if you:

✔ Take 1–3+ trips per year

✔ Are okay with comparing redemption options

✔ Want free flights / free hotel nights (not just cashback)

My Real Example:

I used Capital One Venture points to cover:

Roundtrip holiday flight → Paid $42 instead of $502

That felt really good. But yes — it required planning + choosing the right airline partner.

Cashback vs Travel Rewards, Which One Is “Better”?

Honestly, neither. They just fit different spending styles.

If your goal is… → Choose:

Goal | Best Reward Type | Why |

Save money now | Cashback | Instant, predictable value |

Take free or discounted trips | Travel Rewards | Points can be worth way more |

You buy everything on Amazon | Amazon cashback | Easy 5% return |

You host dinners or feed a family | Grocery cashback cards | 4–6% is unbeatable |

You want one simple card | Flat-rate cashback | No mental effort |

⭐ My Mixed Strategy (Easy + High Value)

Here’s the approach I personally use:

Card Style | I Use It For | Reason |

High Cashback (Groceries + Streaming) | Holiday meals & everyday food | Saves me hundreds yearly |

Amazon Cashback Card | All holiday gifts | 5% back adds up fast |

Travel Rewards Card | Flights & hotels | Turns spending into free travel |

→ This gives me money back today + free trips later.

No overthinking required.

⚠️ The One Rule That Makes Rewards Worth It

Always pay the statement balance in full.

Interest rates are 20–30%+.

Rewards are worthless if you carry debt.

Treat the card like a tool — not extra money to spend.

✅ Final Takeaway

If you want… | Choose… |

Guaranteed savings | Cashback cards |

Vacations without paying | Travel rewards cards |

The best of both | Use one of each, strategically |

The key isn’t having more cards — It’s using the right card for the right purchase.

Related Article:👉 Best Credit Cards for Holiday Shopping Rewards 2025

More Popular Reports

More Popular Reports

-

5 Free Tools I Use to Boost Productivity, Without Paying a Subscriptionfree AI productivity tools for professionals best AI tools to save time at work AI tools for remote workers and creators

5 Free Tools I Use to Boost Productivity, Without Paying a Subscriptionfree AI productivity tools for professionals best AI tools to save time at work AI tools for remote workers and creators -

Best Money Apps to Reset Your Budget in 2026best budgeting apps for Americans living paycheck to paycheck 2026 high-yield savings apps to rebuild emergency fund in 2026 subscription management apps to cancel unused monthly charges

Best Money Apps to Reset Your Budget in 2026best budgeting apps for Americans living paycheck to paycheck 2026 high-yield savings apps to rebuild emergency fund in 2026 subscription management apps to cancel unused monthly charges

Share

Share