who pays for Trump's tariff?

President Donald

Trump’s aggressive tariff policies have been a cornerstone of his economic

agenda, both in his first term and now in his second. While he argues that

tariffs protect American industries and workers, economists and trade experts

overwhelmingly agree that the costs are ultimately borne by U.S. businesses and

consumers—not foreign exporters. Here’s a breakdown of who really pays for

Trump’s tariffs and how they impact the economy.

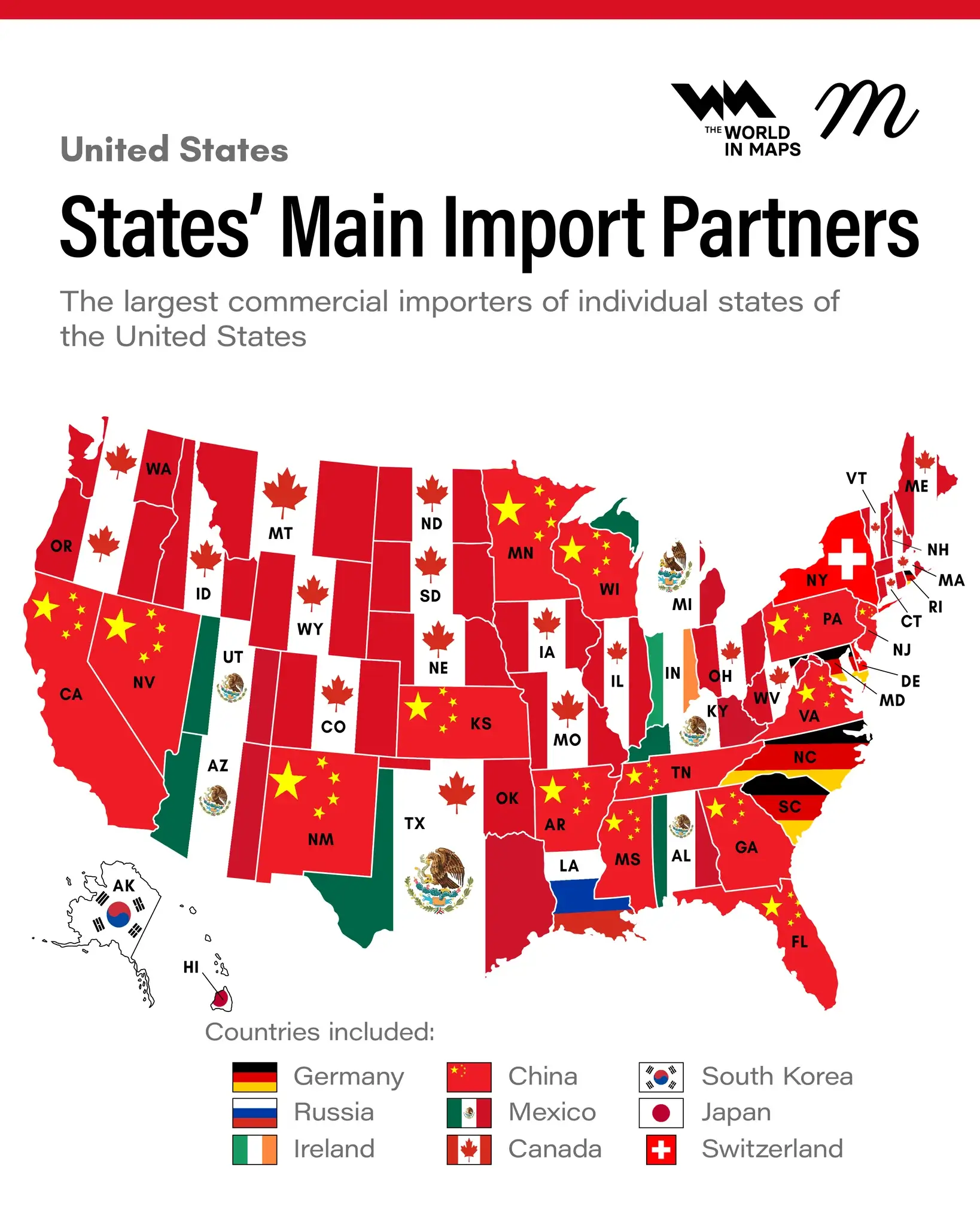

1. U.S. Importers Pay the Tariffs Directly

Contrary to Trump’s rhetoric that foreign countries foot the bill, tariffs are taxes paid by U.S. companies that import goods. For example, If a U.S. retailer imports washing machines from China, it must pay the 104% tariff to the U.S. government at customs. Research from the National Bureau of Economic Research (NBER) found that nearly 95% of tariff costs were absorbed by U.S. importers, with foreign exporters bearing only a minimal share.

2. Consumers Face Higher Prices as Costs Are Passed Down

While businesses initially pay the tariffs, they often pass these costs to consumers through price hikes: Washing machines and dryers saw price increases of 86 and 92, respectively, after Trump’s 2018 tariffs. Car prices could rise by 4,000–10,000 due to tariffs on auto parts from Mexico and Canada. Furniture and kitchen cabinets became 7.1% more expensive under previous tariffs. Economists Mary Amiti, Stephen Redding, and David Weinstein found that U.S. consumers bore almost the full burden of Trump’s first-term tariffs.

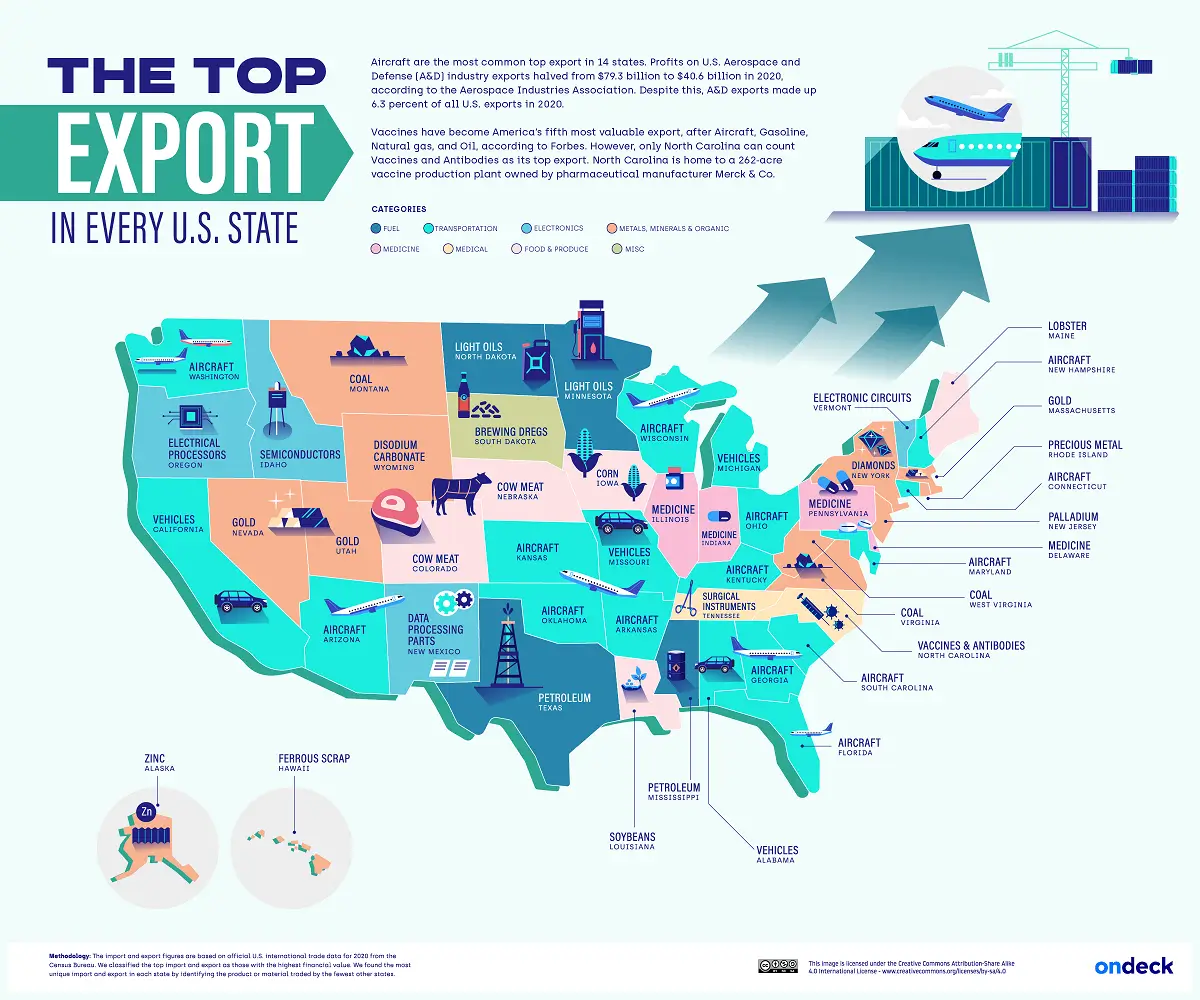

3. U.S. Exporters Suffer from Retaliatory Tariffs

When other countries retaliate, American exporters lose access to key markets: China imposed an 84% tariff on U.S. goods (later raised to 125% after Trump’s escalation). The EU targeted $22 billion in U.S. exports, including soybeans and motorcycles. Farmers and manufacturers face declining sales, as seen when China slashed purchases of U.S. agricultural products in 2018-2019.

4. The Federal Government Gains Revenue—But at a Cost

While tariffs bring in government revenue, the amounts are far less than Trump claims: He boasted tariffs would generate 2 billion per day, but actual daily customs revenue is closer to 200 million. The Tax Foundation estimates that even with higher tariffs, the economic damage (lost jobs, reduced growth) outweighs revenue gains.

5. Trump’s Defenders vs Critics

Trump’s Argument: He insists tariffs protect American jobs and force trading partners to negotiate. His trade adviser, Peter Navarro, has long advocated for aggressive tariffs, clashing with free-trade advocates like Elon Musk. Critics’ View: Economists like Chad Bown (Peterson Institute) and Michael Coon (University of Tampa) argue tariffs act as a hidden tax on Americans, reducing purchasing power and economic efficiency.

Conclusion: Americans Bear the Burden

Despite Trump’s claims that tariffs punish foreign competitors, the evidence shows that U.S. businesses and consumers pay the price through higher costs, reduced product availability, and retaliatory trade barriers. While some protected industries (like steel) may benefit short-term, the broader economic impact is negative.

More Hot Topics

More Hot Topics

More Hot Topics

More Hot Topics

-

The long-awaited Black Myth Wukong will be available for download soon

Black Myth Wukong Release date Game Science Steam wishlists Pre-order Soulslike Chinese mythology Journey to the West Action RPG 2024 release GamesAug 15, 2024

The long-awaited Black Myth Wukong will be available for download soon

Black Myth Wukong Release date Game Science Steam wishlists Pre-order Soulslike Chinese mythology Journey to the West Action RPG 2024 release GamesAug 15, 2024 -

ChatGPT's Money-Making Secret: Predicting the UEFA Euro Quarterfinals

ChatGPT UEFA Euro Quarterfinals Spain Germany Portugal France FootballJul 5, 2024

ChatGPT's Money-Making Secret: Predicting the UEFA Euro Quarterfinals

ChatGPT UEFA Euro Quarterfinals Spain Germany Portugal France FootballJul 5, 2024 -

Stars & Stripes Savings: Top Memorial Day Sales You Don't Want to Miss

Memorial Day sales Memorial Day weekend getaways on a budget Memorial Day historyMay 28, 2024

Stars & Stripes Savings: Top Memorial Day Sales You Don't Want to Miss

Memorial Day sales Memorial Day weekend getaways on a budget Memorial Day historyMay 28, 2024

Share

Share