10 Best Mobile Banking Apps to Manage Money Smartly

Did you know that over 60% of millennials and 57% of Gen Z rely primarily on mobile banking apps? With these numbers on the rise, it’s clear that mobile banking has become a staple for managing finances in today’s digital age. But while many banks offer mobile apps, not all of them provide the features and security you need. So, how do you decide which app is right for you?

I’ve evaluated numerous mobile banking apps to find the top contenders for 2024. Here’s my list of the ten best mobile banking apps that can streamline your banking experience and keep your finances in check!

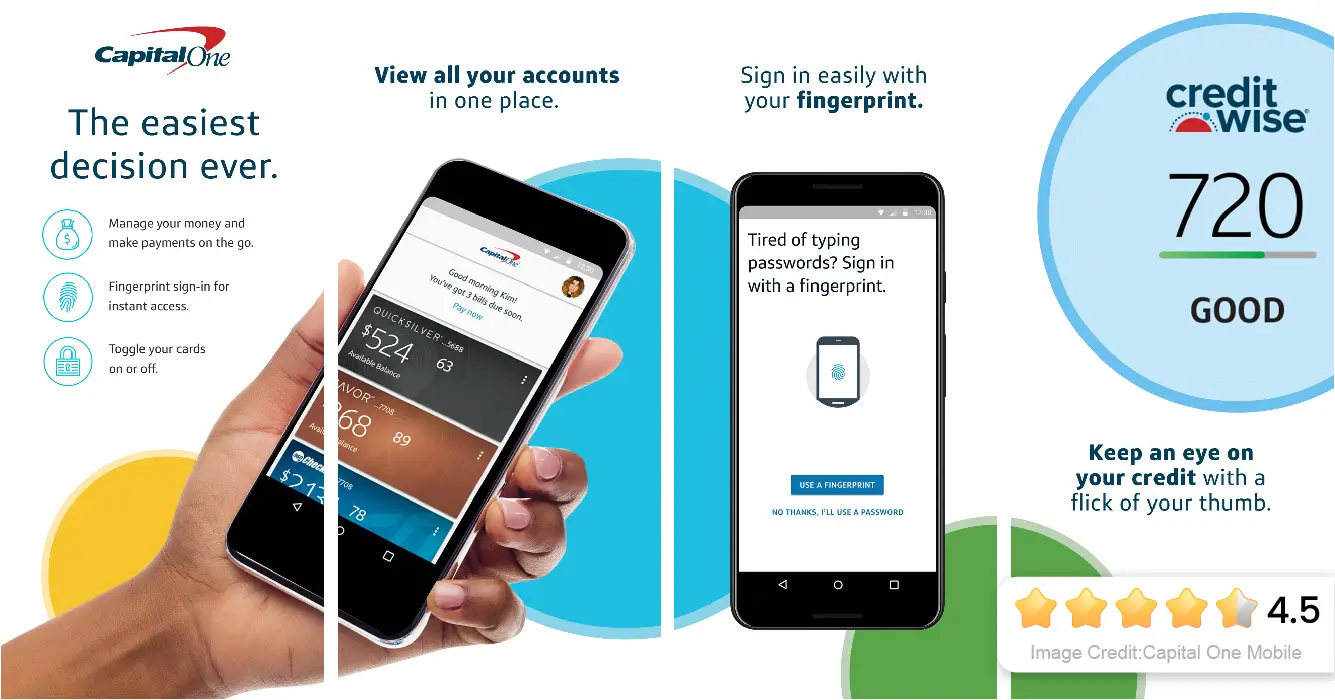

1. Capital One Mobile- Best for Digital Banking Assistant

Capital One takes the lead with a robust app featuring check deposits, bill payments, and Zelle integration. With ratings of 4.9 and 4.5 on the App Store and Google Play, respectively, it’s clear that users appreciate its comprehensive functionality.

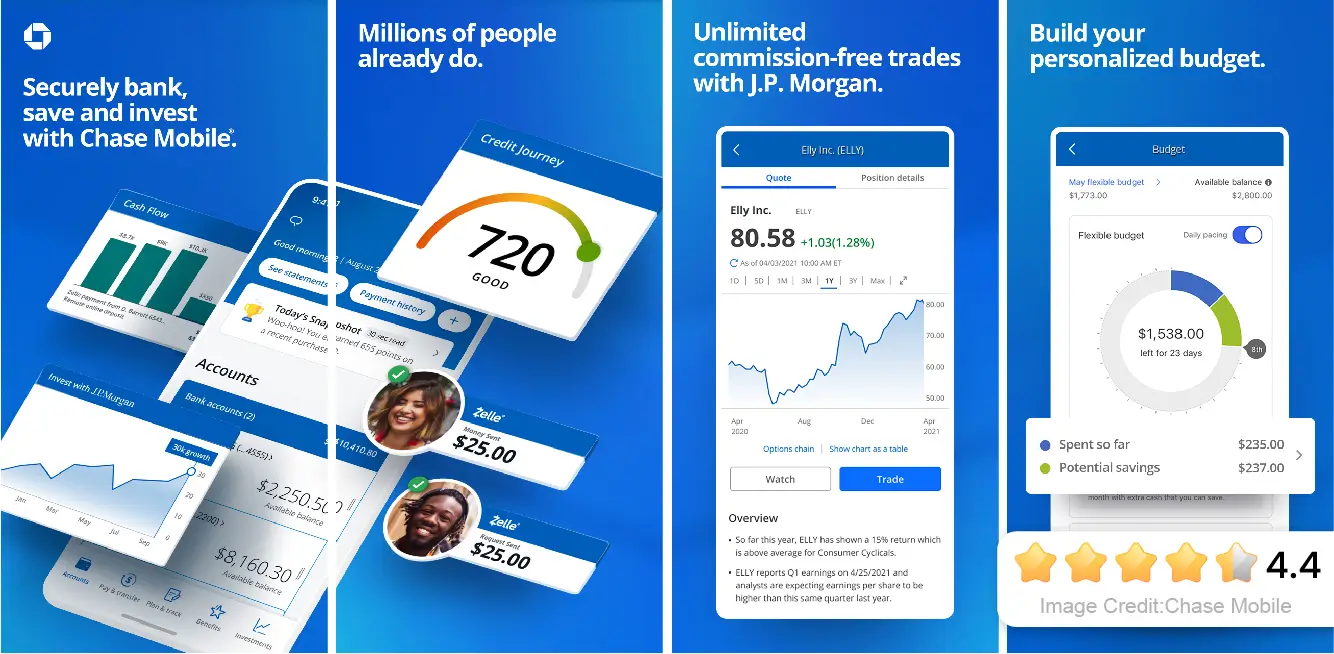

2. Chase Mobile-Best for In-App Wealth Management

With an average rating of 4.4 stars on the App Store, Chase Mobile offers features like fraud monitoring and in-app budgeting tools. It’s a solid choice for those looking to manage their finances effectively.

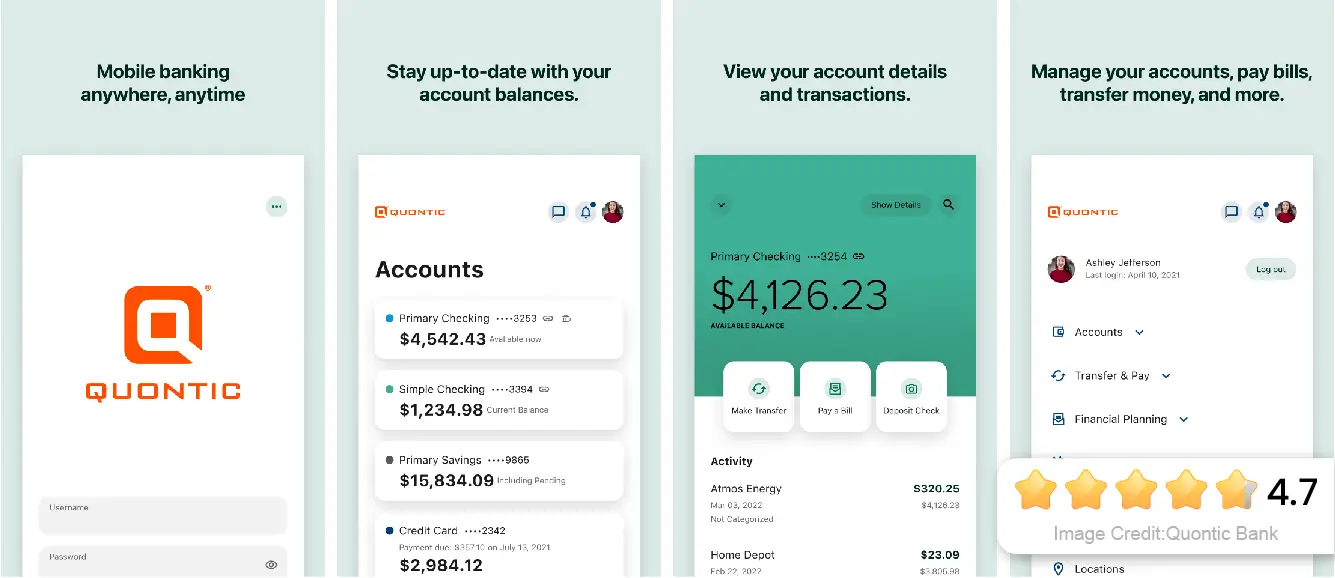

3. Quontic Bank- Best for busy checkers

Quontic’s app shines with a rating of 4.7 and includes biometric authentication for enhanced security. It allows users to check balances, deposit checks, and monitor their credit scores—all at their fingertips.

Quontic Bank doesn’t charge overdraft fees. For the online banker who isn’t diligent about checking their account balance, this could be a lifesaver. What’s more, Quontic offers multiple customer support options and mortgage products in addition to its checking and savings accounts.

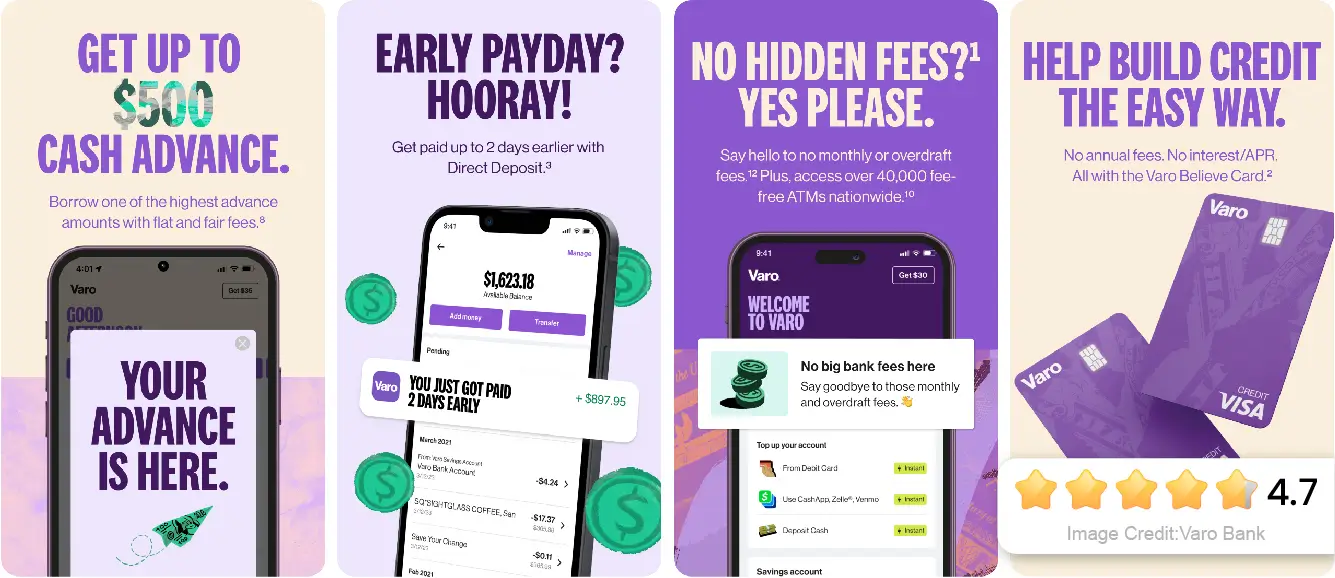

4. Varo Bank: Mobile Banking- Best for Alert Lovers

Varo’s app scores high with real-time transaction alerts and customer support via live chat. With ratings of 4.9 and 4.7 stars, it’s user-friendly and efficient for everyday banking tasks.

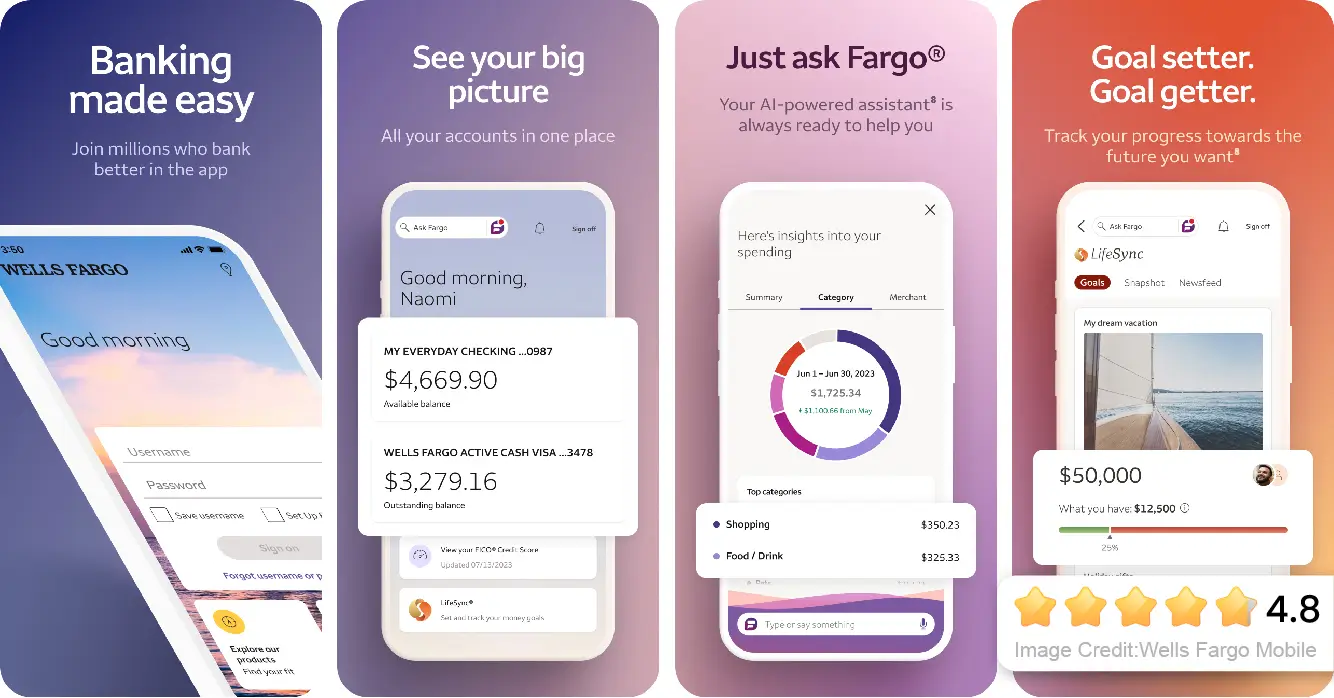

5. Wells Fargo Mobile Wells

Fargo’s app is packed with features, including FICO score access and a virtual assistant for quick queries. With ratings of 4.9 and 4.8 stars on the Apple Store and Google Play, it’s a reliable option for many users.

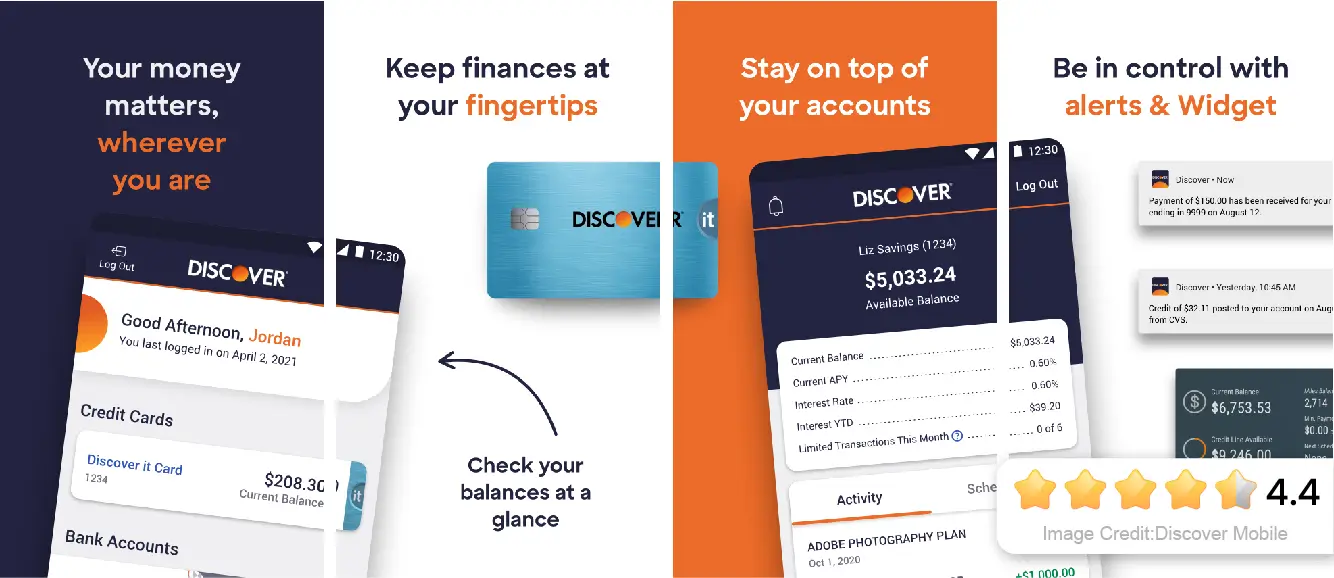

6. Discover Mobile

Offering mobile check deposits and Zelle payments, Discover’s app prioritizes security with card-locking capabilities and biometric login. It’s well-rated at 4.4 stars on both platforms.

There are also in-app card locking capabilities, which make it easy to keep your money and your personal information safe if you suspect that it may have fallen into the wrong hands. The app also allows you to log in using your fingerprint, facial recognition, or a four-digit code for an added layer of security.

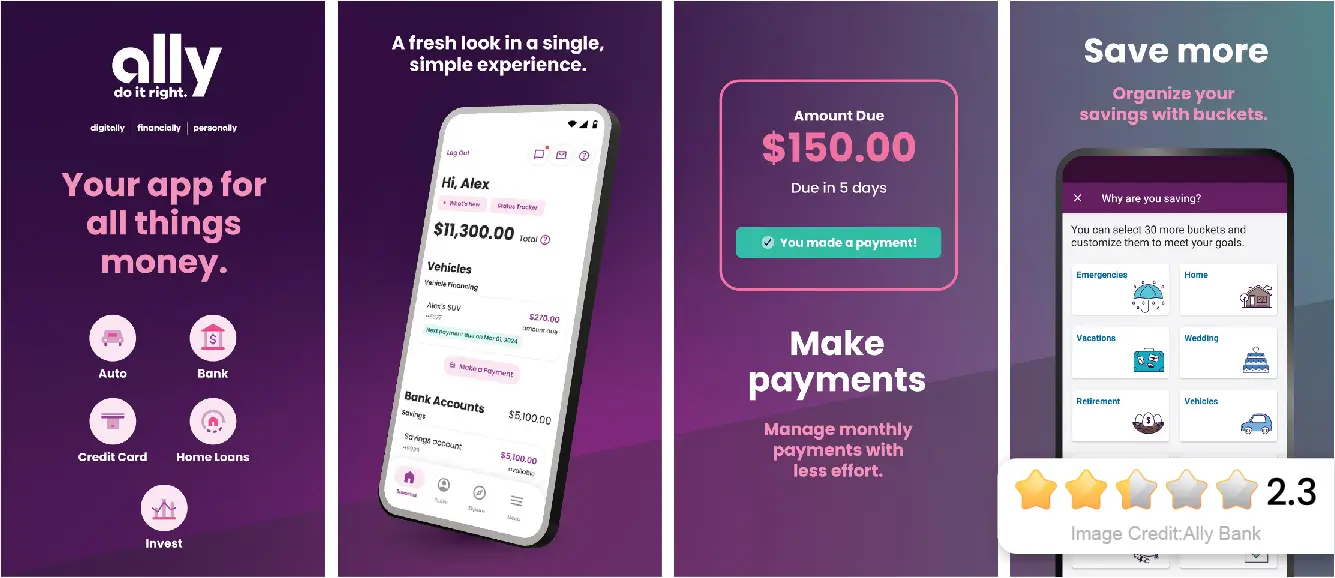

7. Ally Bank

Despite a mixed rating of 4.7 stars on the App Store and 2.3 stars on Google Play, Ally bank app is packed with useful features like fund transfers and bill payments.

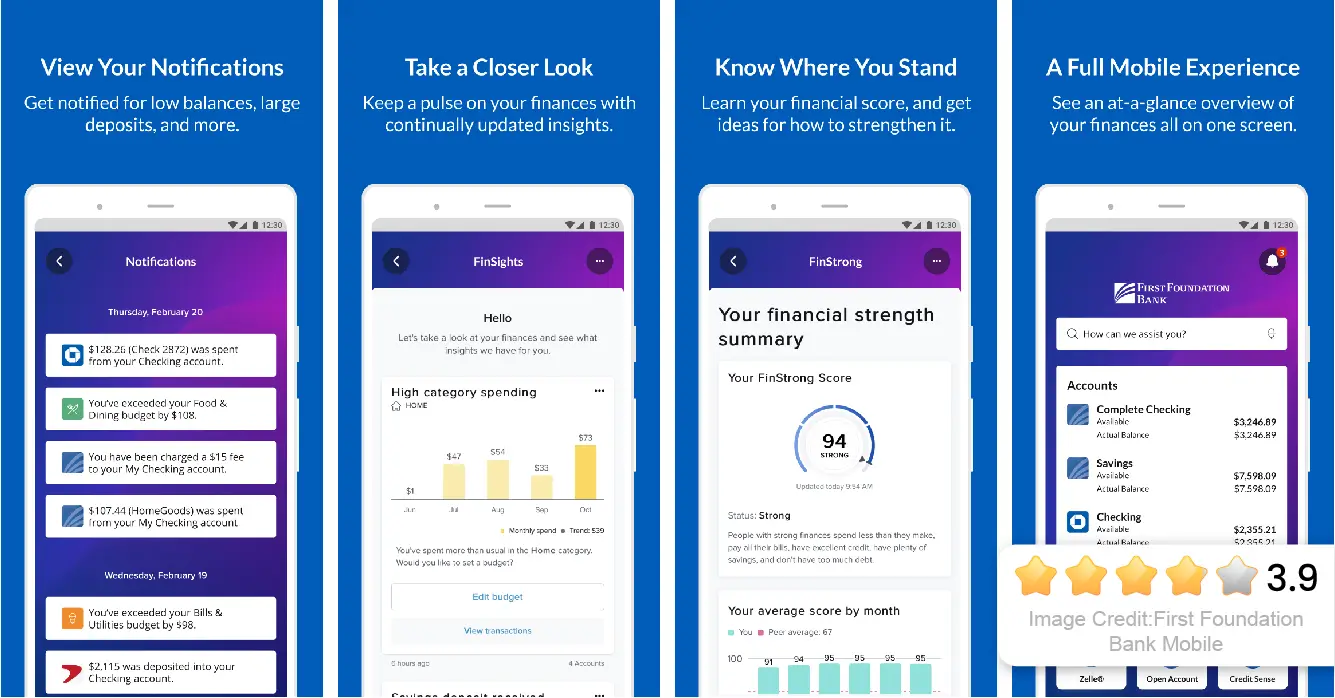

8. First Foundation Bank Mobile

First Foundation Bank Mobile lets you sync accounts and monitor transactions while providing personalized insights into your spending. It’s a great option for those looking to gain a deeper understanding of their finances.

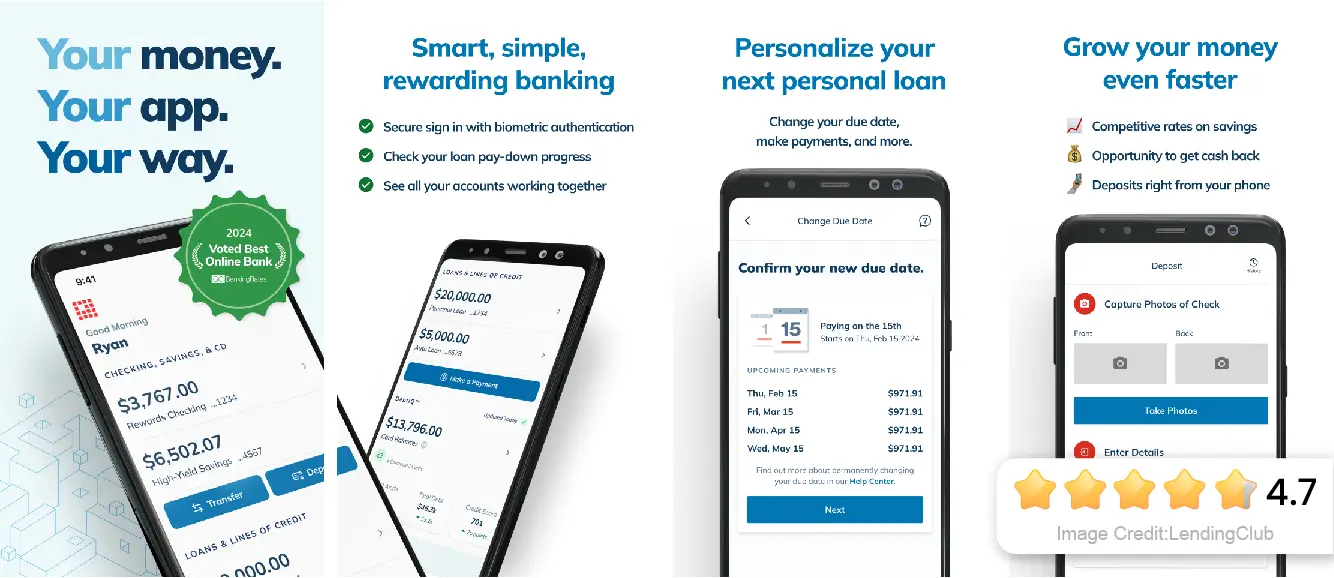

9. LendingClub

LendingClub app offers easy loan management and credit score monitoring. With ratings of 4.8 stars on both stores, it’s a solid choice for borrowers.

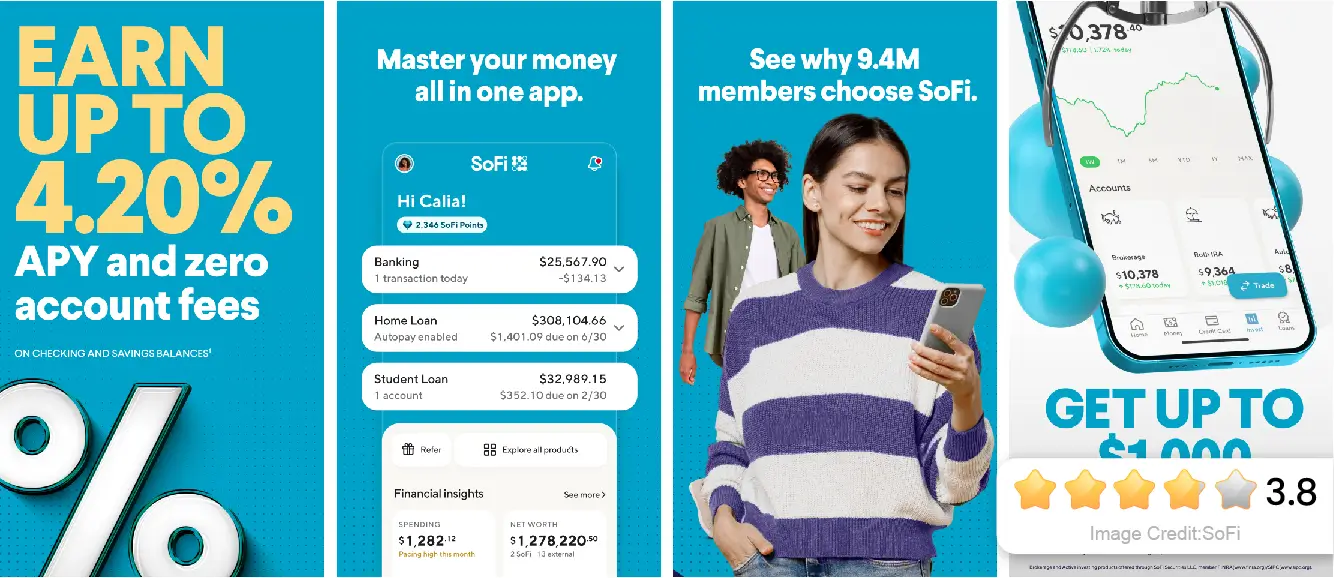

10. SoFi

SoFi rounds out our list, providing features like savings goals and round-ups. Its security measures, including two-factor authentication, make it a safe option for managing your money.

Other Financial Apps to Check Out

While a mobile banking app is a fantastic tool for managing your finances, having a few additional apps can really enhance your financial picture. Personally, I find that using specialized apps for budgeting and investing makes a significant difference.

Here are some other types of financial apps I recommend:

- Budgeting Apps: To keep your finances in check, consider using budgeting apps like Rocket Money for creating budgets, Honeydue for managing shared expenses with your partner, and Empower for comprehensive wealth management.

Cash Advance Apps: While I suggest using them sparingly, cash advance apps can be lifesavers in emergencies. Some of the top options include Current, EarnIn, and Varo.

Investing Apps: If you're looking to start planning for your financial future, investing apps like Interactive Brokers, Acorns, and Betterment can help you take that first step.

By incorporating these apps into your financial routine, you can gain greater control and clarity over your money!

Conclusion

Mobile banking apps have revolutionized how we manage our finances. Whether you’re checking balances, depositing checks, or tracking spending, the right app can make all the difference. Consider your banking habits and preferences as you explore these top ten mobile banking apps for 2024—your perfect financial companion is just a download away!

Frequently Asked Questions About Mobile Banking Apps

1. Are mobile banking apps secure?

Yes, most mobile banking apps employ advanced security measures such as encryption, two-factor authentication, and biometric login options to protect your sensitive information. However, it’s always important to take precautions, like regularly updating passwords and using secure Wi-Fi connections.

2. Can I open a bank account using a mobile banking app?

Many banks allow you to open a new account directly through their mobile apps. However, this feature varies by bank, so it’s a good idea to check with your specific bank for details on their mobile account opening process.

3. What features should I look for in a mobile banking app?

When choosing a mobile banking app, consider features like check deposits, bill payments, budgeting tools, real-time alerts, security options, and in-app customer support. These features can significantly enhance your banking experience.

4. How do I use mobile check deposit?

Mobile check deposit typically involves taking a photo of the front and back of your check using your bank’s app. The app will guide you through the process to ensure the images are clear and complete before submitting for deposit.

5. Is there a fee for using mobile banking apps?

Most banks do not charge fees specifically for using their mobile apps. However, be sure to review your bank's policies and any potential fees related to your account or services offered through the app.

I love sharing funny Apps or games so as to add joy in your life or enhance your productivity. My goal is to provide clear, actionable insights that make understanding Google Play trends easier and empower creators to succeed in a competitive market.

More Popular Reports

More Popular Reports

-

Financial Minimalism: Spending Less on Things, More on LifeFinancial Minimalism Intentional Spending Value-Based Budgeting Lifestyle Design Financial Freedom

Financial Minimalism: Spending Less on Things, More on LifeFinancial Minimalism Intentional Spending Value-Based Budgeting Lifestyle Design Financial Freedom -

Understanding Economic Cycles: How to Prepare Your Finances for a RecessionEconomic Cycles Recession Preparation Financial Resilience Emergency Fund

Understanding Economic Cycles: How to Prepare Your Finances for a RecessionEconomic Cycles Recession Preparation Financial Resilience Emergency Fund

Share

Share